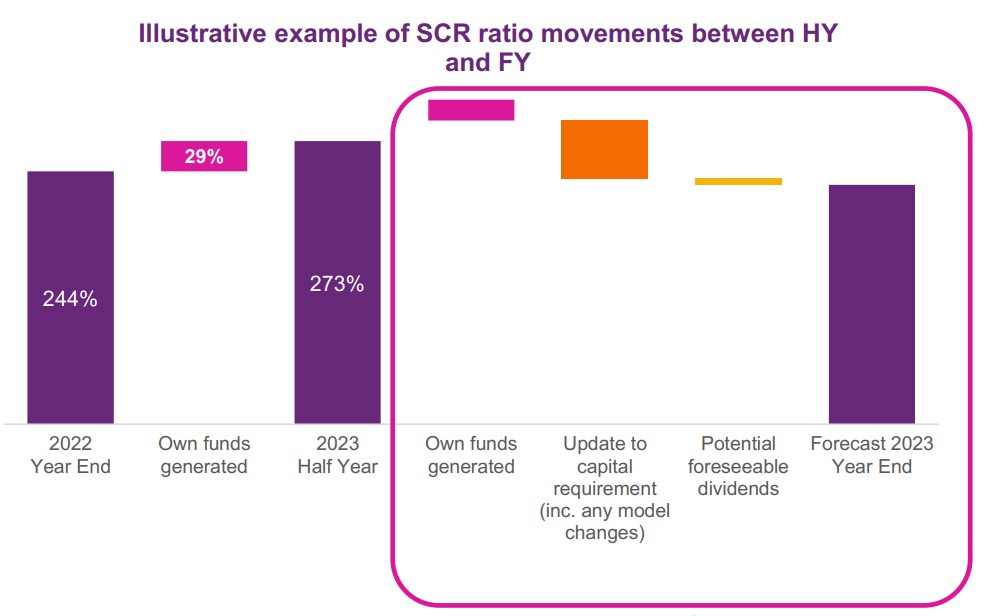

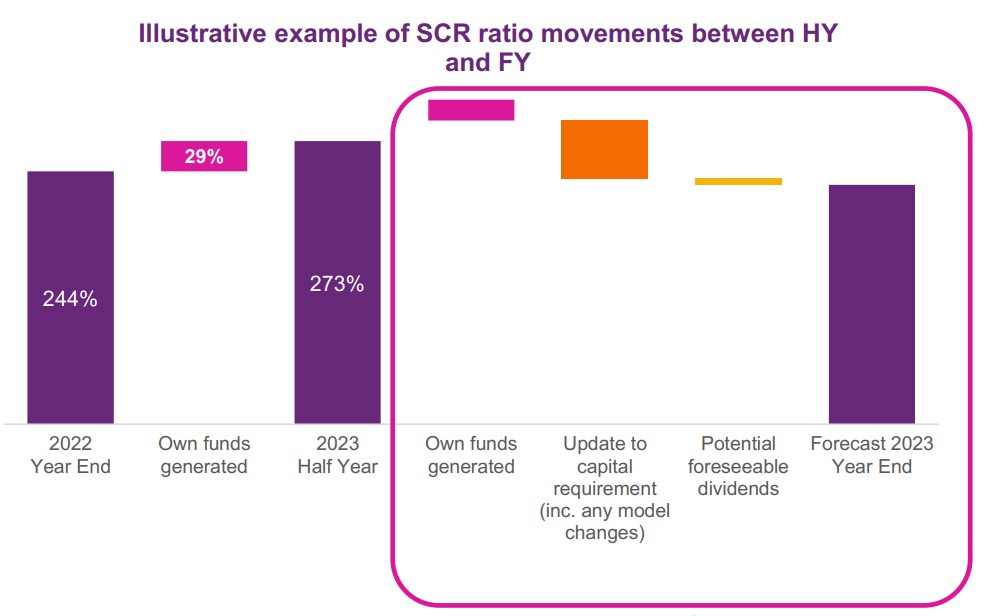

The Solvency II ratio is the ratio of Eligible Own Funds to SCR; with the SCR representing the capital an insurer would need to hold to be 99.5% (dependent on jurisdiction) certain it can meet its liabilities over the next 12 months.

A company's Solvency II ratio may fluctuate during the year for various reasons. Here's an illustration of how the SCR ratio may be higher at half year than at the end of the year; as half year only includes the current year's capital requirements, whereas by the end of the year the business plan for the next year may have been decided upon, and the SCR ratio may consider how capital will be deployed during the following year. Illustration below is an extract from Beazley's 30 Jun 2023 financials.

For legal reasons please consider everything written on this website to be for entertainment purposes alone. It's vitally important to question everything and apply your own mind.